In an effort to aid the business community, the country’s central bank has loosened import approval requirements and urged banks to prioritise the import of essential goods such as food, pharmaceuticals, and energy.

As a result of challenges in establishing letters of credit, members of the business community have approached State Bank.

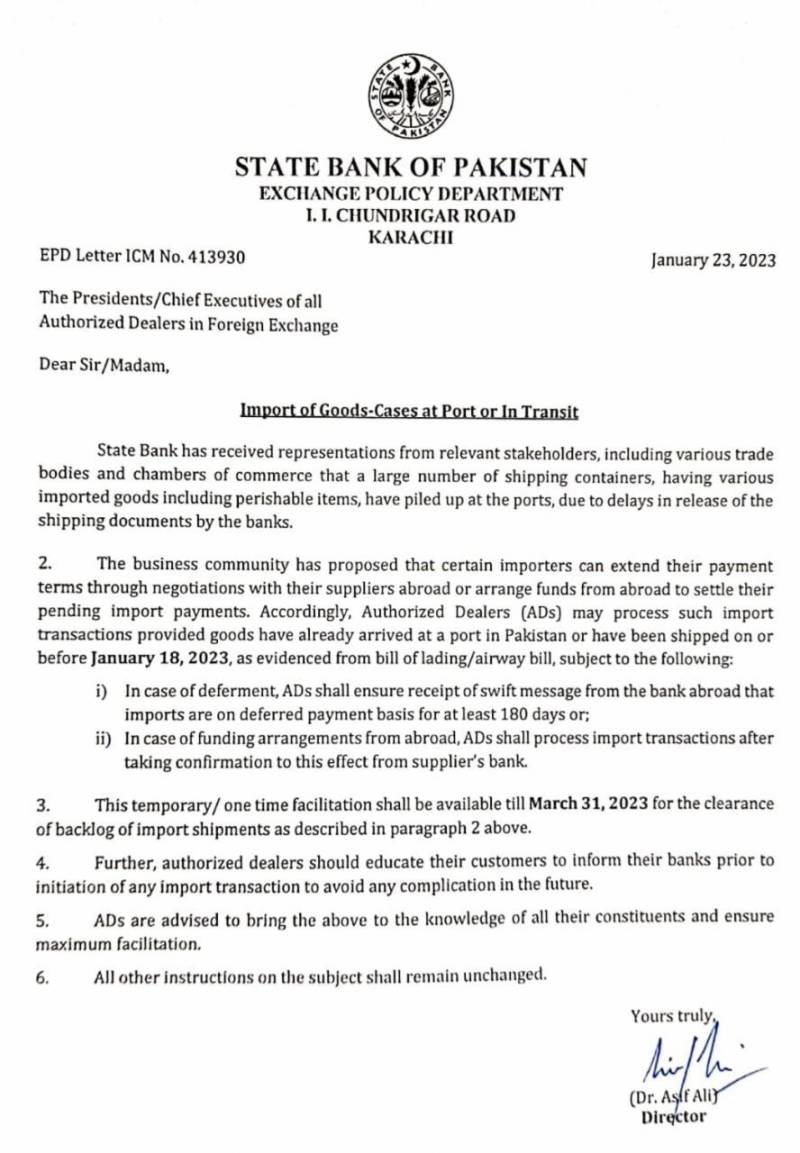

The State Bank of Pakistan stated in a statement that merchants, including various trade organisations, have indicated that shipping containers containing imported goods are stalled at the ports due to delays in the delivery of shipping paperwork by commercial banks.

With a sigh of relief, the central bank loosened the prior approval requirement for imports that fall under HS code Chapters 84 and 85, as well as certain commodities under HS code Chapter 87, and instructed banks to prioritise the import of essential goods.

It requested that commercial banks provide one-time assistance to importers who could extend their payment terms to around six months or arrange funds from abroad to cover outstanding import payments.

The statement continues, “Therefore, until March 31, 2023, banks are instructed to process and release documents for shipments and goods that have already arrived at a Pakistani port or were shipped prior to January 18, 2023.”

SBP also requested that commercial banks instruct their customers to contact their banks prior to initiating any import transaction in order to avoid any unforeseen circumstances.